The Moment Everything Changed: Google’s Quantum Breakthrough on Bitcoin

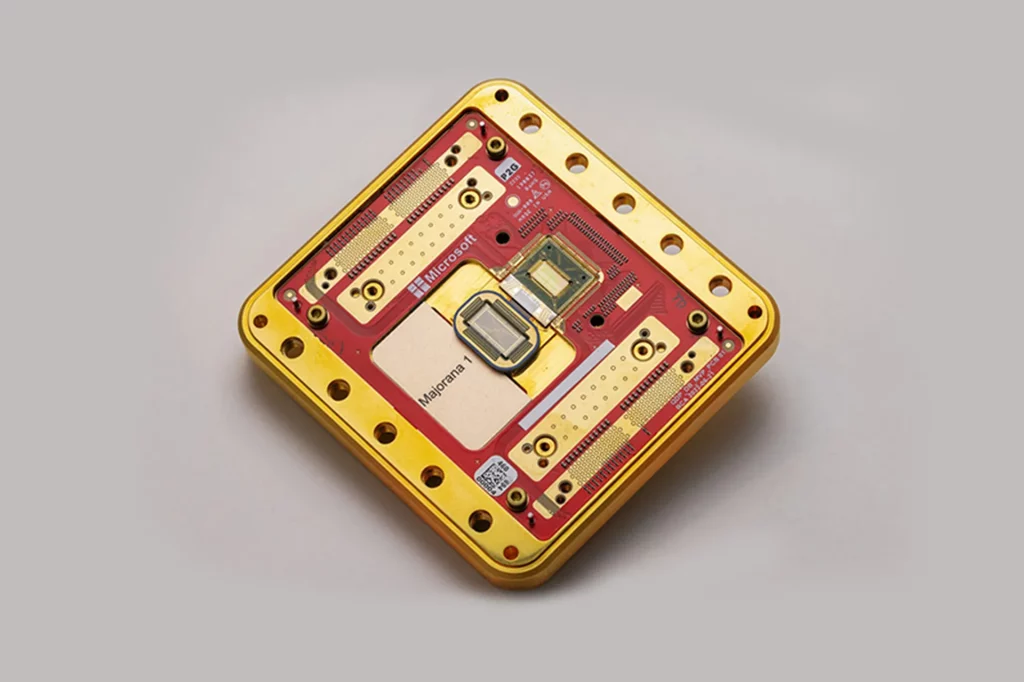

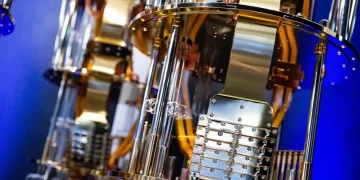

In April 2025, a research team from Google’s Quantum AI division conducted what would become one of the most disruptive demonstrations in the history of cryptography. Utilizing their newly unveiled Sycamore X quantum processor—boasting over 10,000 error-corrected qubits—they performed a controlled, academic-grade attack on Bitcoin’s foundational cryptographic infrastructure. In a secure test environment, the team successfully reverse-engineered a Bitcoin private key from a public wallet address by exploiting the widely used Elliptic Curve Digital Signature Algorithm (ECDSA), which had long been considered uncrackable by classical computers.

Although the researchers did not extract funds or target real-world wallets, they published a detailed breakdown showing how a scalable quantum computer could feasibly compromise existing blockchain systems that rely on public-key cryptography. The demonstration—conducted with the cooperation of several academic cryptographers and under the ethical oversight of the U.S. Department of Energy—didn’t just theorize quantum supremacy over classical crypto. It made it real.

Google’s whitepaper clarified that the attack, though resource-intensive, required only about 6 hours of runtime and less energy than a day of mining on a mid-sized Bitcoin farm. The team emphasized that their goal wasn’t to panic the ecosystem but to accelerate industry migration to quantum-resistant algorithms. But the warning shot had already been fired. Within minutes of the public announcement, chaos began to ripple through the crypto world. Bitcoin’s price, which had been holding steady above $60,000, dropped 17% in two hours. Market participants realized that a future vulnerability had arrived ahead of schedule.

Industry Turmoil: The Great Crypto Security Race Begins

The reaction from crypto exchanges, developers, and custodial platforms was swift—and, in many cases, panicked. Major exchanges like Coinbase, Binance, and Kraken immediately suspended transactions involving high-risk legacy wallets. Emergency advisories urged users to transfer funds to multisig addresses or newer wallets with hybrid encryption schemes. Ethereum developers pushed an unscheduled hard fork proposal, signaling the chain’s readiness to shift toward quantum-hardened primitives, even at the cost of short-term instability.

Wallet developers raced to push security patches. Hardware wallet manufacturers, including Ledger and Trezor, issued urgent firmware updates with transitional encryption support. The industry, long aware of quantum computing as a theoretical threat, now faced an existential timeline measured not in decades, but months.

Smart contract platforms, especially those built on Solidity or WebAssembly, were particularly exposed. Many used digital signature schemes vulnerable to quantum factorization or discrete log-based attacks. Protocol teams like Chainlink, Solana, and Polkadot scrambled to commission code audits and begin transitioning to NIST-recommended post-quantum algorithms like CRYSTALS-Dilithium, Falcon, and SPHINCS+.

The shift wasn’t just technical—it was behavioral. Long-time holders with dormant wallets were suddenly seen as vulnerable targets, with many fearing that black-hat actors could replicate Google’s process in underground labs. Over $30 billion in crypto assets, estimated to be sitting in legacy single-key wallets created before 2016, became the focal point of speculation. Would they be stolen, moved, or lost in the digital void?

Governments also took notice. The European Central Bank, which was piloting a digital euro, announced a full security reassessment of its cryptographic backend. The U.S. Federal Reserve convened an emergency consortium involving the NSA, NIST, and leading fintech firms to assess systemic risk. For the first time, quantum computing was no longer just a frontier tech—it was a live threat to global digital infrastructure.

Winners Amid Chaos: Post-Quantum Startups Skyrocket

While much of the crypto world scrambled to defend, a select group of companies emerged as unexpected beneficiaries. Startups specializing in post-quantum cryptography—long considered niche players in a theoretical future market—suddenly found themselves at the center of investor attention.

QuantumShield, a Zurich-based cybersecurity firm that had developed a drop-in post-quantum encryption module for blockchain applications, saw its valuation triple within a week. Their client list expanded overnight from experimental DeFi platforms to central banks and defense contractors. Shares in the firm, which had recently gone public via a Swiss tech index, surged 480% in four trading days.

In the U.S., the Austin-based company Algoforge, which had been developing a post-quantum Layer 1 blockchain from scratch, raised an emergency $500 million Series C round led by Sequoia and BlackRock. Algoforge’s architecture, built entirely on lattice-based cryptographic primitives, became the blueprint for next-gen blockchains, as legacy chains struggled with backward compatibility.

Even dormant projects like NTRUChain and PQ-Bit—once mocked as overly paranoid—experienced a renaissance. Their open-source repositories surged with new contributors, and token values tied to their ecosystems exploded as investors sought exposure to the “quantum-secure” narrative.

Meanwhile, educational platforms and code auditing firms that specialized in quantum-resistant cryptography saw a hiring boom. The number of GitHub forks for NIST PQC finalist algorithms increased tenfold. Universities offering courses in quantum-safe systems reported record enrollment. In a world where the next security breach might come from a cold lab in Switzerland or Shanghai, digital trust became the most valuable asset of all.

A Changed Landscape: The Dawn of the Post-Quantum Blockchain Era

The 2025 quantum demo didn’t collapse blockchain—but it changed its DNA forever. The event catalyzed what industry insiders now call the “Great Migration”: a global, cross-platform effort to transition every critical blockchain system to post-quantum cryptography.

This shift has led to new standards emerging across the ecosystem. Many platforms now use hybrid signature schemes combining classical and quantum-safe layers, allowing backward compatibility with traditional wallets while preparing for future threats. Wallets created after mid-2025 feature embedded quantum entropy generators and multi-layered key derivation paths that can adapt based on network signal of a verified quantum threat.

More subtly, trust models have evolved. Hardware wallets began incorporating quantum verifiers that authenticate signatures based on their algorithmic source. Exchanges created “quantum status indicators” on transaction dashboards, helping users identify whether their assets are stored using quantum-safe protocols. In this new world, secure asset custody is no longer a passive service—it’s an evolving product.

Yet the transition hasn’t been entirely smooth. Some older blockchains with rigid consensus rules or massive legacy codebases have faced breakage and downtime. Legal debates around whether a wallet’s private key—if cracked through quantum methods—still counts as legitimate ownership are raging in courtrooms. And the grey market of pre-2025 wallets, now considered dangerously vulnerable, has spawned a cottage industry of conversion services, insurance, and, unfortunately, fraud.

But in the broader picture, the shock of Google’s quantum hack may have been a necessary wake-up call. It ended the long-standing complacency around digital signatures and forced the blockchain industry to innovate once again. Far from destroying trust in decentralized systems, it revitalized the cryptographic backbone that underpins them.

Now, in the post-quantum blockchain era, survival belongs not to the strongest code, but to the most adaptable. And in that spirit, the 2025 quantum breach will likely be remembered not just as a security event, but as a generational turning point—when blockchain met its first existential threat and emerged, transformed.

Discussion about this post